Citi has added a 48 month restriction to AAdvantage credit card sign-up bonuses. Previously, you could get the same sign-up bonus on these cards every 24 months (before that went into effect, it was 18 months). So now you have to essentially wait four years between sign-up bonuses. That makes the AAdvantage cards much less churnable, which is unfortunate because the card has always offered a solid sign-up bonus.

What this means for credit card churning

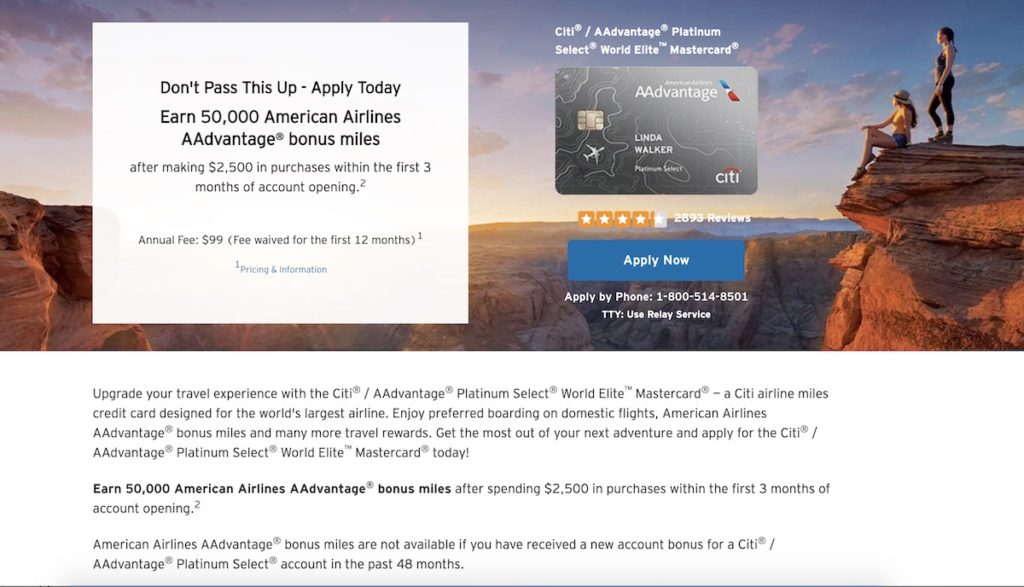

One 50,000 – 75,000 miles sign-up bonus every four years is not great. Citi’s new 48 month restriction on AAdvantage credit card sign-up bonuses means you should probably time your applications to get a higher sign-up bonus.

At the moment the Citi AAdvantage Platinum card is offering 50,000 miles after $2,500 spent in 3 months. Often, Citi will run targeted or public promotions for 65,000 and 75,000 bonus miles instead. Now that you can only get this sign-up bonus every four years, you might want to hold out for a bigger bonus.

Keeping the Citi AAdvantage Platinum card long-term?

With the 48-month wait period between sign-up bonuses, you might be wondering if it’s still a good idea to toss the card after the first year. It might not be, if you want to continue earning AAdvantage miles on regular expenses as well as manufactured spending.

I’m not a big card churner, so I find the $125 Flight Discount reason enough to keep my AAdvantage card long-term. However, I was also tempted by another ~60,000 mile sign-up bonus. Obviously, that decision has now been made for me. Flight Discount voucher it is.

The up side of Citi’s 48 month sign-up bonus restriction

Citi’s new 48 month restriction on AAdvantage sign-up bonuses isn’t all bad. As Gary points out, Citi now treats each AAdvantage card as a separate product. So if you just picked up a Citi AAdvantage Platinum card, you can still apply for the Citi AAdvantage Executive card without waiting 48 months.

Alternative: Barclay Aviator Card

If Citi’s new 48 month wait period between sign-up bonuses is putting a damper in your card churning plans, you can always pick up a Barclay AAdvantage Aviator Red Card instead. It currently has a better sign-up bonus than the Citi AAdvantage public offer: 60,000 miles after first spend.

Is Citi’s 48 month restriction on AAdvantage Card Sign-up Bonuses worse than 5/24?

My first thought when I saw Citi’s 48-month restriction on AAdvantage card sign-up bonuses was “Citi is about to pull a 5/24.” But it’s not that bad. For starters, there are other AAdvantage sign-up bonuses you can get during that 48 month wait period – from Barclays and Citi, now that Citi treats all the cards as individual products.

Additionally, the Citi AAdvantage Platinum card is not in the same league as the affected Chase credit cards. I keep getting these cards and earning American miles because it’s so easy, but redeeming them can be a huge hassle.

Not to mention, I’ve now had two instances where I’ve showed up at the airport with a confirmed ticket but couldn’t board my flight. American Airlines was super helpful, dropping my calls repeatedly and then sending me an email four days later asking me to call customer service to resolve the issue.

But enough of my complaining – I want to hear from you: Will Citi’s new 48-month restriction on AAdvantage card sign-up bonuses affect your churning strategy?

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Leave a Reply