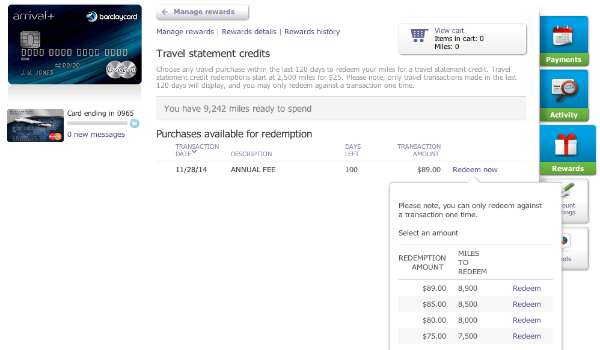

One of my favorite credit cards, and one I don’t mind paying the $89 annual fee on, is the Barclay Arrival Plus card. I get great use out of it, though I know others wonder they should cancel it after the first year. Or perhaps downgrade to the no-annual fee version. Thankfully, there is a way to off-set the annual fee altogether: Redeem Arrival Miles. Yes, the $89 annual fee on the Arrival Plus card is coded as a travel purchase and can thus be redeemed with Arrival Miles at a rate of 1 cent per point. For the full $89, you’ll need 8,010 Arrival Miles after the 10% travel redemption rebate has been applied.

At an earnings rate of 2 Arrival Miles per $1, it takes just $4,005 in spending to off-set the $89 annual fee. This shouldn’t be too difficult or costly, despite the increasing difficulty of manufactured spending. Here are a few suggestions as well as the cost involved:

American Express Serve ($0)

Thanks to the $1,000 monthly online load allowance, you can generate 8,000 Arrival Miles free of charge after just four months of loading Serve with your Arrival Plus card. This is the easiest and cheapest option of them all.

Simon Mall Gift Cards ($31.60)

The cost of buying Simon Mall gift cards recently increased to $3.95, which is still competitive compared to what other gift cards are charging. Picking up $4,000 worth of Visa gift cards and unloading them via Bluebird will cost $31.60 in fees. This obviously isn’t as great as $0 in fees, but considering this cuts down your annual fee by 1/3, it’s still a good option if you don’t want to go the Amex Serve route.

American Express Gift Cards ($8.35)

I don’t know about you, I definitely took the 4% cash back shopping portals previously offered on Amex gift cards for granted. Now, the best we can expect is 1.5% cash back from TopCashBack (my referral link). At this rate, $4k in gift card purchases would cost $16.85 in fees. You would also generate $60 cash back. Unloading these via Amex for Target would incur $51.50 in load and ATM fees, bringing your total out of pocket expenses to $8.35.

American Express for Target ($51)

In the case of another cash back portal pull-out, you may have to skip Amex gift cards altogether and opt for direct Amex for Target loads. Simply take your card to Target and load it at the register with your Barclay Arrival Plus card. The cost of doing this is much higher at $51 but again, it’s cheaper than paying $89.

Everyday Spending ($0)

The fact that the Arrival Plus card pays out 2 miles per $1 on all spending makes it a viable option for everyday spend. When I’m not meeting massive spending requirements, this is what I do. It’s the equivalent of earning 2.2% cash back on your non-category spend, which is as good as it gets.

These are just a few ways to off-set the $89 annual fee on the Barclay Arrival Plus card. The bottom line is that the annual fee is coded as a travel purchase. So you can use your Arrival Miles to off-set the cost.

For me, the Barclay Arrival Plus card has paid for itself many times over, covering Hyatt Points + Cash awards (like the one at the Hyatt Carmel Highlands), airline taxes and fees, and acting as an alternative currency when it makes more sense to redeem Arrival miles than hotel points or airline miles. The card really comes in handy in these situations, helping to conserve points and save cash.

So if you just can’t stand the thought of paying $89 a year for the privilege of earning miles, then the fact that you can eliminate the full cost should be reason enough to hold onto your Barclay Arrival Plus card.

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Those are good options but the first thing I will do is to ask for fee waiver. The worst thing that can happen to you is a NO. I called for fee waiver and they said I have enough points to pay half the fee, so they will waive the rest of it. Better than nothing.

That’s good! I’ve gotten turned down when asking for fee waivers so much, I don’t even bother asking anymore.

I am pretty sure rebate does not kick-in for annual fee redemption as in my case. Can you confirm if otherwise.

You do get the rebate, surprisingly. When I went to checkout, the rebate was applied.

For those few active duty military personnel who may read this…Barclay’s, just like Amex, will waive annual fees on their cards under the SCRA. These two credit card issuers are the most military friendly merchants out there…along with Busch Gardens/Sea World!

You sycophants with your military worship. It’s a government job that involves terrorizing civilians with less military power, illegally occupying countries, blindly following orders under the guise of “defending our freedom.” But let’s applaud anyone who dishes out amusement park discounts for puppets of white imperialism.

Wow!!! Thank for for showing me the light!

Maybe I should resign my commission tomorrow!! 😉

Oh, I can’t, ya know…those religious holidays are about and those gov’ee workers are all on holiday!

What say you, about those companies that provide any form of a extra benefit not available to non-puppets of white imperialism? I’m curious as to what your opinion is on them and how I (and all of us for that matter) should view them?

Shame on me for expecting an intelligent response from someone who has to be told what to think. Your spelling is embarrassing.

Did you “really” expect an intelligent response from me (or anyone else for that matter) based upon your rant against military men & women? Seriously?

You got an simple and appropriate response for your haranguing.

Gotta Love the Liberal Elite (and wannabe’s) when they come out of the woodwork, thinking they are the only ones entitled to something while at the same time putting down others due to being agnorant themselves.

Is not there a protest somewhere that you must attend to?

😉

Yeah you’re a great example of the heroes of this country. So intelligent and mature!

I just had my fee waived after a second phone call. The first person said they would try and would speak to their supervisor and call back. When I did not receive a call (not surprised) I called again and with no issues had the annual fee reversed and an additional 5000 points if I spent $1000 in 3 months. Pretty decent for a few phone calls!

That’s awesome, Lori! Why did they offer you the 5k bonus? Did you threaten to cancel the account?

Ariana, can you load Serve account(from authorized CC user) with an a secondary CC (authorized user) card from the Primary card holder ?thanks

Yes, loading Serve with a card that you’re an authorized user on will work.

Simon Mall gift cards have gone up to $3.95, but you don’t have to use their cards. I’ve been able to buy gift cards at other malls for $2.95 that are loadable to Bluebird.

True. I’ve been hearing about other malls offering these as well. Maybe I’ll do a post one of these days on that subject.

My nearest Simon Mall still keeps the $3 fee, but the big change that they made is that they only allow the sale of 1 gift card per visit.

Scott , could you share which corporate malls you bought the GC from ?

Hello Ariana,

I just recently got the BARCLAY ARRIVAL +…quick Q: can you get a statement credit for passport fees (travel expense in my opinion no?)

Walt

I don’t think so, though that would be very convenient! The purchase would have to be processed as a travel merchant and that’s probably not the case.