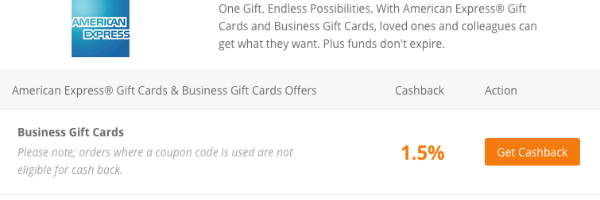

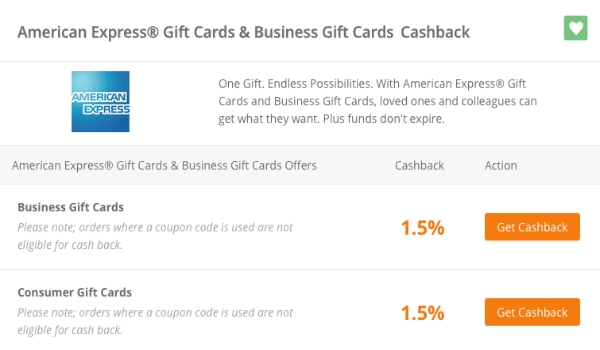

TopCashBack is once again offering cash back on American Express gift cards! 1.5% to be exact. Earlier this month, every shopping portal removed American Express gift cards from the lineup. It was a pretty big deal, since it knocked down $10,000 in monthly profitable manufactured spending. AAnyway there’s no telling how long this will last. So if you’ve got some spending requirements to knock out, this is the time to do it. If you’re not currently a TopCashBack member, consider using my referral link to join. I’ll earn a $10 referral when you sign up and make a purchase.

This is perfect timing for me, as I’m wrapping up my $82,000 spending challenge. This just about takes care of it. If you just picked up the 70,000 point version of the Ink Plus card, hopefully this offer will still be around by the time your card gets in so you can knock out the $5,000 spend easily.

If you’re just using this as an opportunity to generate extra cash, you might want to pair it with the Fidelity American Express card, which offers 2% cash back on all spending. The Barclay Arrival Plus is also a great option, as it earns 2.2% in travel credits. Either way, this is a good way to get a large chunk of spending done. The only cards you shouldn’t use are those issued by Citi. That’s because they code Amex gift card purchases as cash advances. In my experience, keeping orders at $4,000 or less ensures they won’t get canceled. It’s not a guarantee, but it has worked for me in the past.

If you’re going to use the TopCashBack portal to order American Express gift cards, be sure to take screenshots of the entire transaction. In case it isn’t tracked. I’ve never had a problem with tracking, but a lot of folks who use TopCashBack have, so it’s always best to be safe. Keep in mind that Amex gift cards are not PIN-enabled, so the only way to unload them is via Google Wallet (which tacks on about 3% in fees) or by using them to purchase PIN-enabled Visa or Mastercard gift cards. Another option is to use them to load American Express for Target cards, though this can be a hit or miss depending on the cashier you’re dealing with.

HT: Howie at Frugal Travel Guy

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Leave a Reply