UPDATE 5/5/14: It appears Big Crumbs has decreased the payout to 2.45%. Thanks to Teri for letting me know!

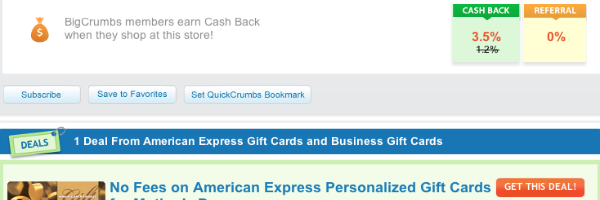

A few weeks ago I wrote about Barclay RewardsBoost and TopCashback increasing the payout on American Express gift card purchases. TopCashback continues to offer 3% cash back, while the Barclay Rewardsboost portal offers 4 miles per $1 spent. Combined with the 2 miles per $1 from the , this comes to 6% in travel credits (3% if you redeem your points for statement credits). At the time, I predicted Big Crumbs would be joining in with an increased offer and two weeks later, they have. You can now earn 3.5% cash back by purchasing American Express gift cards through Big Crumbs. There is no indication when this offer ends (which is as high as cash back gets on Amex gift cards), so if you’re looking to generate extra points/cash or meet the spending requirement on the 60,000 point Ink Bold card, you might want to get on this now.

If you’re unfamiliar with the purpose of buying American Express gift cards, you can read up on this and manufactured spending in the recently completed newbie guide.

Doing the math

Currently, Big Crumbs is also listing promo code FPMOM, which waives the $3.95 fee on each gift card. Combined with 3.5% cash back, you are looking at significant profits. If you purchase the maximum $5,000 in gift cards and opt for 2-day shipping at a cost of $8.95, you’re looking at an initial profit of $166.05.

Cashing Out

Your final profits will depend on how you decide to cash out your gift cards. You can cash out $1,000 free of charge via Amazon Payments. You can also purchase Simon Mall gift cards at a cost of $2.95 per $1,000. If you don’t have access to a Simon Mall, you can head out to your local grocery store and buy $500 PIN-enabled Visa gift cards at a cost of $3.95-$5.95.

Once you have your PIN-enabled gift cards in hand, head to your local Walmart and use them to load your Amex Bluebird card at the Bluebird kiosk free of charge. Bluebird cards can be loaded up to $1,000 per day/$5,000 per month. Once your Bluebird card is loaded, go through the online bill pay center to pay off the credit card you used to buy American Express gift cards.

You can also use gift cards to buy money orders at a cost of $0.22-$0.90 per $1,000 but some Walmart locations won’t accept cards that don’t have a name on them.

Take the money orders to your local branch and either deposit them into your account or use them to pay off the credit card you used for the initial transaction. For example, if you used your Chase Ink Bold card, there are lots of Chase branches around these days where you can pay your bills. Simply make out the money order to Chase and ask the teller to put it towards your credit card balance.

Things to keep in mind

If you’re going to purchase American Express gift cards, you should be aware of the following warnings and potential issues:

1. Shopping Portal Tracking

Shopping portal tracking technology isn’t always reliable, so if you’re clicking through a shopping portal, take screenshots of the transaction as proof in case your cash back doesn’t post. Some folks have had this issue with both TopCashBack and Big Crumbs.

2. Cash Advance Fees

Some credit card companies will code American Express gift card purchases as cash advances. If this happens, you will not only miss out on points/miles but you’ll get hit with huge cash advance fees. This Flyertalk thread has a list of issuers that code these purchases as cash advances. This list does change from time to time, so make sure you check it before making any purchases.

3. Organization

If you’re going to play the manufactured spending game, it’s very important that you keep track of your spending and make sure your credit cards are paid off on time. If you can’t get yourself to walk into a Walmart and load your Bluebird card, then this isn’t for you.

4. Money orders

Refrain from depositing large amounts of money orders into your bank account. I personally just take the money orders to a local branch and pay off my credit card. This keeps me off the banks’ radar and allows me to keep manufactured spending.

5. Gift cards

If you’re going to use your American Express gift card to buy Visa or Mastercard gift cards, make sure they are PIN enabled. Otherwise you’ll end up with a bunch of cards that you have no choice but to spend. Gift cards issued by Bancorp, US Bank, and MetaBank are generally safe to use.

6. $1 Hold

If you’re using Amazon Payments to unload your American Express gift cards, keep in mind that Amex puts a $1 hold on the card that drops off after a few days. In other words, set your payment amount to $999 instead of $1,000.

Gift card churning isn’t for everyone, but if you’re organized and responsible, it’s very profitable both in terms of points/miles and cash. Will you take advantage of the 3.5% payout from Big Crumbs?

Disclosure: I will receive a commission if you sign up for the Barclay Arrival card using the link in this post. TopCashBack and Big Crumbs also pay out a small commission when you use my link to register and earn rewards. I appreciate your support, regardless of whether you use my links or not.

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Leave a Reply