Happy New Year everyone (seems the period to keep saying it never ends)! It’s not off to a great start, thanks to Barclay shutting down all of my credit cards. And my family’s. This happened about four days ago after I checked into the Conrad Dubai.

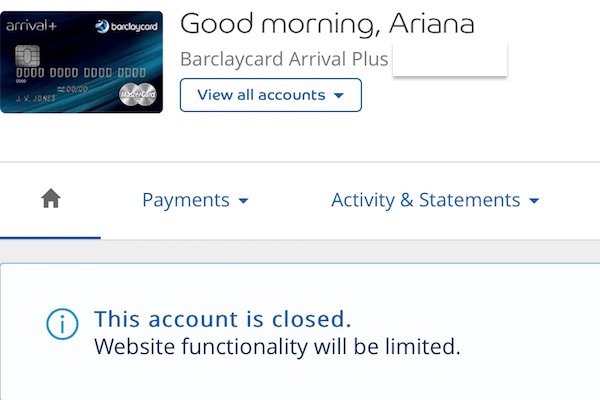

Everything was fine at check-in. Then I got a notification from Uber that my payment information needed to be updated. My brother came back that afternoon and said his Barclay Arrival Plus World Elite MasterCard was declined. I figured it might be a fraud alert issue. When I logged into my account and saw this notice, I knew it was over:

I checked both of my Barclay credit cards along with those belonging to my parents and brother. All of them had been shut down. It’s actually not all that surprising considering the amount of manufactured spending I’ve been putting on these cards over the last two months. But I don’t even think it was about the spending. I think I committed the cardinal sin of paying off the card balance via Walmart Bill Pay.

My friend Karyn had warned me about this, explaining that her Barclay Arrival card was shut down as well due to Walmart Bill Pay. I heeded her advice for a long time, but since I was churning so many Visa gift cards over the last month, I needed more than just money orders to unload them all.

That’s when I decided to start using Walmart Bill Pay to pay off some of these credit card balances. I’m convinced that’s what did it. Why? Because I don’t think I put more than $5,000 on my mom’s credit card last month. But I did use Walmart Bill Pay to pay off the entire balance.

Unlike most people who have been shut down in the past, I was able to redeem my remaining Arrival miles. This was great because it meant I was able to off-set most of my travel expenses while in the Middle East. So the glass is still half full as far as I’m concerned.

However, it does mean fewer point-earning opportunities for me because I’ve not only lost one of my most valuable flexible rewards credit cards, but my Barclay cards also happened to have had the highest credit limits of any cards in my wallet. It’s all a bit disappointing, but not the end of the world. I still have Chase, Amex, and Bank of America and I can reapply in 6 months.

Now that my trip is over, I’ll also be cutting down on manufactured spending. It has taken up a lot of time over the last month. Not to mention space, because I couldn’t fit all the gift cards I was churning in a normal trash can anymore. I ended up with a pile of boxes around my room, filled with gift cards and receipts I couldn’t toss until all the balances were paid.

I’ll continue to resell merchant gift cards with The Plastic Merchant, since I can easily do that from home and it’s less risky in terms of credit card shut-downs. Merchant gift cards can be purchased from a variety of retailers, so my spending patterns will appear much more normal than if I was purchasing Visa gift cards at my local mall or online.

Hopefully this is a cautionary tale for some of you. If you’re going to use Barclay credit cards for manufactured spending, don’t use Walmart Bill Pay to pay off the balance. I knew that, took the risk anyway, and got my accounts shut down.

If it has happened to any of you, I’d like your feedback. How did you get your Barclay credit card accounts shut down and how soon after were you able to reapply?

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Leave a Reply