My brother did something awful recently that managed to frustrate the hell out of me. It’s not entirely his fault. As the Keeper of the Miles, I sometimes do a bad job of being transparent and explaining this hobby to my family. I’d rather just handle it all myself. Well, that practice bit me in the a** recently when I found out my brother is going on a trip to D.C. Very soon.

Is he driving there, because how come he hasn’t asked me about booking his ticket and hotel yet? It turns out he’s going to tour several med school campuses in the area and staying with different students. That explains the lack of hotel booking. But it turns out he also paid for his own ticket…using his Chase Ink Bold card!

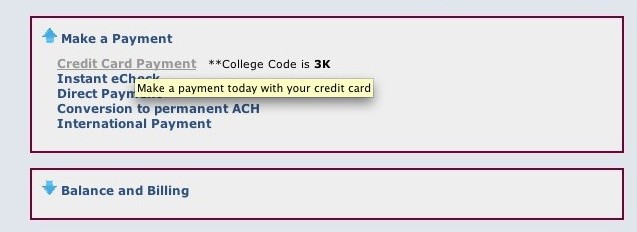

I confronted him about his lapse in judgment. At $380 RT it would have made a perfect Arrival miles redemption. It turns out he was clueless about the powers of the Barclay Arrival Plus World Elite Mastercard (to be fair, I’m holding onto it for him to rack up manufactured spending via Amex gift card orders) and since he’s always hearing about my gift card buying and Target-hopping, he assumed there was a mileage shortage and earning more would be too much of a hassle for me. So I guess it’s actually a thoughtful thing he did, but I wish he’d at least talked to me so I could have saved him money, told him we’ve got plenty of miles and that my frequent trips to Target are just me being greedy.

Anyway, this incident has made me reconsider the way I micro-manage everyone’s mileage accounts and credit cards. While I’ll continue to do it, I recognize the need for transparency. Otherwise, misunderstandings happen and people end up putting airfare charges on the wrong credit card.

I’ve also made it clear to everyone that we have millions of points and miles to spare. And to please check with me before making any more travel bookings. I clarified that while buying $50,000 worth of gift cards and unloading them at Target looks like a hassle (and it is, sometimes), I really do get a kick out of it. So no one should see it as a strenuous activity. There are people working difficult jobs year-round who still can’t afford to travel. Me hopping around Target stores is a cakewalk in comparison.

Going forward, I’m going to make an effort to explain the different rewards programs and what purpose each of them serves in my travel hacking strategy. This will hopefully prevent similar situations from happening in the future and make everyone feel more involved.

Are you managing your family’s frequent flyer accounts? Have you ever had a similar situation come up because of a lack of transparency?

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Can you explain what card you use to buy the Amex Gift cards, where you buy them from and how you unload them.

The card depends, but it’s mostly the Barclay Arrival. The process is explained in the Amex gift card link in this post.

Just curious – why still going the Amex gift card route? Isn’t it easier to load at target directly with the credit card? Is the only reason you do the Amex gc because of the portal rewards? Just curious 🙂

Yep, 1.5% cash back is why I torture myself like this. 🙂

I manage my family’s account and tell them to ask me before booking tickets. That said, I don’t bother making a big fuss out of a “bad redemption”. He paid $380 and earned 1 UR point/dollar. Instead, you wanted him to use points from a 2.2% card. Depending on how you value UR points (some would say ~2 points/dollar), you’re stressing out over <$10 or much less.

I believe her point was not about the new miles earned by using the Barclay card…it was to use the Barclay card so the arrival miles she already had available could pay for the ticket…saving him $380

Yes, that’s the reason – not so much because of the reward currency earned but the fact that the cost of the flight could have been wiped out with the Arrival Miles I’ve got stockpiled.

Hi Ariana, It is hard to be in control all the time and expect them to know what we know. I get the same thing in my family all the time. I have learned to try and get them to do their own bookings, but talk to them about the best options first. Most of the time, the rest of the family can’t be bothered doing anything that takes more than one extra step (even though we drive to target and order GCs on line, etc. etc. routinely). My daughter is a first year med. student and I had her get a SW and UA cc the year before she applied. I am proud to say she didn’t have to pay cash for any of her interview trips, and had to cancel and reschedule several times (to add or drop a visit). She rarely stayed in a hotel (but we got good last minute deals or used points) and once I had to use Avios a few days in advance for an extra interview. It was SO worthwhile having a varied stock of miles and points to help her out (and she learned the value of having them too). Now we are juggling flying cross country from PDX-NYC to visit her a few times a year…..

Good luck to your brother.

Thanks Laura! Hopefully things work out as well for him as they did for your daughter. It sounds like you’ve got a good system down.

l hope this comment doesn’t seem selfish but aside from merely helping a family member do you get anything in return for all of your efforts in managing their accounts such as their Social Security number so that you can have another Redbird and increase your personal monthly MS capacity? i’m just thinking that I barely have enough time to do all of this for myself let alone others.

Not at all selfish. I do get their permission to obtain and load Redbirds and credit cards in their name. We share our miles, so when I meet a spending requirement for my dad, I get to use those miles I helped him earn, so it’s not entirely selfless.

I’ve given up on trying to help my family, though I’m thankful my sister just got me a Redbird card from Boston earlier this week. I’ve given her so much information on what cards to use and how to MS in the last year and yet she paid for her and her daughters’ flights to visit. One of her kids asked me which is the best card to get for a trip to Europe. I explained the Citi AAdvantage gives 50,000 miles, enough for an off-season RT or close to a peak season RT. My sister immediately interjected with, “don’t get that card. It has an annual fee.” There’s no fee the first year and then it’s $95. Even if there was an annual fee the first year I would think it’s worth $95 for a RT to Europe! But if that’s the type of logic my sister is going to use then all my information has gone in one ear and out the other.

The annual fee really freaks people out, I’ve noticed! My aunt asked me to recommend a card with a generous sign-up bonus and no annual fee. I explained to her she won’t get very far with no-annual fee cards but she wasn’t interested. She didn’t want to get a card and have to worry about canceling on time to avoid the fee.

Yeah, the scary annual fee occurring the second year. It is a huge inconvenience to set up a google calendar reminder so that a month before the annual fee you call the credit card asking it be waved, or to close the acct or downgrade it to a no fee card. Instead, it makes much more sense to pay hundreds–or thousands–of dollars for that trip that you’d have gotten for free with miles.

What to us seems like the plain obvious thing to do, to some of our family/friends seems like convoluted, or shady, or risky, or all the above. This awesome hobby is not for everyone, to our benefit I should say, consequently.

Couldn’t agree more.

You can fish for them or teach them to fish. I’ve educated my family gradually but it’s all dependent on their willingness to take help. If someone throws up their hands because it’s all so confusing and redeems points for gift cards, there’s not much you can do except show them the opportunity cost.

Very true. It’s entirely my fault they can’t fish – I thought it would be easier (on me and them) if I just did everything myself. Clearly not the case.