Back in November, I wrote about the new Amex Hilton Credit Cards. In addition to introducing three brand new cards, American Express announced the acquisition of Citi Hilton card accounts. At the time, it was reported that existing Citi Hilton Honors cards would transfer to American Express on January 30, 2018.

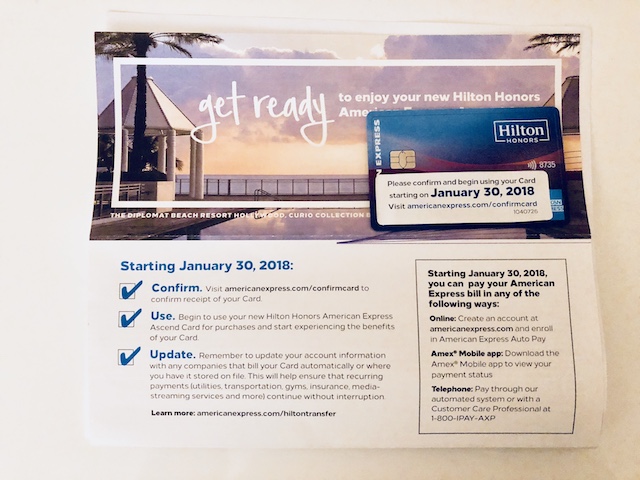

A few readers recently commented that they heard the account transfers would take place on January 15. Well, both reports sort of right. My dad, a Citi Hilton Honors Reserve cardholder, just received his brand new Hilton Honors American Express Ascend Card. The catch? He can’t activate it until January 30.

Hilton Diamond status

While American Express is shipping out new cards now, they can’t be activated until the end of the month. The Amex Hilton Ascend card is pretty much the same as the Citi Hilton Honors Reserve. Cardholders get free Hilton Gold status and the ability to spend their way to Diamond status by completing $40,000 in a calendar year.

Annual weekend night certificate

There’s also an annual weekend night certificate for cardholders who spend $15,000 in a calendar year. That’s higher than the $10,000 spending requirement on the Citi Hilton Honors Reserve, but not a big deal. The card also comes with the following category bonuses:

- 12X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 6X Hilton Honors Bonus Points at U.S. grocery stores, U.S. restaurants, and U.S. gas stations

- 3X Hilton Honors Bonus Points on all other eligible purchases

- 10 free Priority Pass Lounge passes to ease the airport experience

- No foreign transaction fees

$95 annual fee

The Ascend card is essentially an updated version of the Amex Hilton Surpass Card. The category bonuses are actually better than those issued by the Cit Hilton Honors Reserve Card. Overall, this is a solid card…except for one jarring exception: The sign-up bonus.

That’s right – nowhere in the pretty packet they sent does it mention a welcome bonus of any kind for transferred accounts. While we don’t know how many points (or free nights) the new card will offer, chances are it will be more than the nothing American Express is offering to Citi cardholders.

Convenient conversions

American Express is probably counting on convenience generating conversions. It’s certainly nice to get one of these cards (which, by the way, looks similar to the SPG card with the purple hues) two weeks before the Citi Hilton Reserve Card goes bust. And I think the average consumer will probably just think, “Oh how nice! The card is already here, so I might as well.”

Perhaps the American Express logo will seem like an upgrade over Citi (which, to be fair, it is in many ways). But I’m having my dad call Citi first thing Monday morning to cancel his Citi card. Once the Amex Hilton card applications actually go live, I’ll get him a new card. The jury’s still out, since it will largely depend on the sign-up bonus.

My preference

As for my personal preference, I’m looking forward to picking up the Hilton Aspire Card. The category bonuses are incredibly generous and I love that you get Hilton Diamond status right out of the gate. That’s not to say they’ve eliminated the incentive to put lots of spend on the card: Every year, cardholders can earn a free weekend night reward after spending $60,000.

“Why waste $60,000 on a Hilton card?” Because you already get a free weekend night for renewing the card. Stack those two nights together with the minimum 180,000 points earned from the $60,000 spending requirement and you can piece together a 4-night stay at a top-tier hotel like the Conrad Koh Samui.

$250 Hilton resort credit

The card’s $250 airline fee credit on top of a $250 Hilton resort credit is also a nice perk. If you’ve ever been frustrated with the lack of elite benefits at Waldorf Astoria hotels, you’ll appreciate the $100 on-property credit when you book an Aspire Card package. Conrad Hotels are also eligible for this credit.

I imagine American Express is working in their Fine Hotels & Resorts and Hotel Collection benefits, since I’ve seen similar credits listed for Conrad Hotels on AmexTravel. All of these perks more than off-set the $450 annual fee. In fact, just getting top-tier hotel elite status for $450 is a total bargain.

Anyway, now that I’ve harped enough about the above credit cards, I want to hear from you. Have you gotten your new Amex Hilton credit card in the mail? Do you plan on applying for a new account to secure a sign-up bonus or will you activate the transferred account?

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Leave a Reply