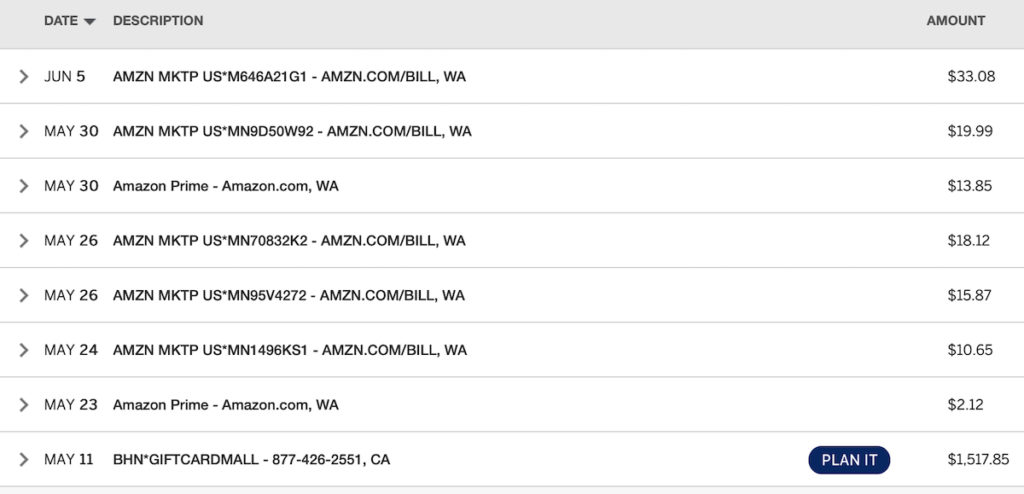

Remember the GiftCardMall credit card fraud I wrote about two weeks ago? It affected several credit cards I’d used at GiftCardMall, including ones issued by Chase, Citi and American Express. In each case, I called the credit card company to dispute the charges and order a new card.

After I reported the fraud, I thought I was done. What I learned was that fraudulent charges can continue on the old card number, even after you get your card replaced.

Fraud notification from American Express

Yesterday, I got a “Card not present transaction approved” email from American Express. I normally receive these after making online purchases. Except, I hadn’t made any purchases with the new card.

I logged into the account and noticed that the previously reported fraud charges were still showing up on the activity dashboard. They had not been refunded. My brother had some fraudulent charges on his Marriott Bonvoy card and those had been credited right away.

Furthermore, there were several additional fraudulent charges that had gone through after I reported my card stolen.

I tried to get this taken care of via live chat, which was a waste of time. So I resorted to calling American Express.

The runaround

After initially claiming that there had been no additional charges since my initial report, the rep said she would open up another fraud case. When I asked her for the confirmation number, she read back the same one I received for the previous case. I asked her to read off all the charges that were listed under that case number and – no surprises – she read back all the old fraudulent charges.

She hadn’t filed a claim and was just giving me the runaround. I asked the agent to once again submit another claim. A minute later she stated that it was done.

“Great! Can I have the confirmation number, please?”

“No. There’s no confirmation number for pending fraud cases.”

I had to check the number I dialed. Was this American Express or the Marriott Bonvoy line? I thought only Marriott members get Bonvoyed, but I guess not. I decided to deal with that BS later. At this moment, I needed her to send me a replacement card since mine was compromised.

“Recurring charges…will always go through, regardless of whether you get a new card”

Her answer? “Your card is secure. Those charges came through after we canceled your card. Recurring charges and ones tied to subscriptions will always go through, regardless of whether you get a new card.”

That leaves cardholders completely open to repeated fraud. Is the expectation really that I get on the phone once a month and report a fresh batch of fraudulent charges until eternity? Of course not.

I’m told that I need to call Amazon and tell them to stop accepting payments for any order placed using my old card number. Considering I threw the old card out after I received confirmation a new one was on the way, that’s a little hard to do. Besides, barring an airline mile promotion, I’ve vowed never to go dumpster diving.

I always thought American Express had it together on the security front. But to tell us that once a thief gets a hold of our card info, they essentially have a lifelong pass to make fraudulent charges? I can’t even wrap my head around that nonsense. What is the point of all this anti-fraud technology they keep investing in if hackers get handed a lottery ticket any time they get access to an American Express card?

Recourse

My only recourse at that point was to cancel the card. Which was fine because it’s the Marriott Bonvoy card and earning those points is not worth the hassle.

While the agent had me on hold to research a solution, I tweeted about this conundrum and Becky mentioned that American Express has the ability to block charges tied to the old card number:

Yes the same thing happened to me. You need to specifically tell them to refuse any and all charges on the old number. They can do it but no idea why it’s not automatic.

— Becky Pokora (@sightDOING) June 17, 2019

I asked the rep and she claimed it wasn’t possible. This was a person in the Amex fraud department. But considering she had gotten so many things wrong during the call so far, I hung up and called back. This time, I indicated that I wanted to close my account and was redirected to the retention department.

The retention rep confirmed that American Express can in fact block charges from cancelled credit cards or from specific merchants. I didn’t want Amazon blocked and I was concerned the old card number would be used elsewhere for “recurring” charges. So I asked her to just block the old card number.

It took about a minute and she confirmed that any attempted charges to the old card number would get declined going forward.

Takeaway

While I was grateful to take care of this finally, I don’t understand why this isn’t automatic. I get it – updating credit card information tied to recurring bills is a huge hassle. But not more of a hassle than having to monitor your account and report recurring fraudulent charges.

Securing a credit card account so that no one else can use it for unauthorized charges should be the primary concern. Not whether it’s a “hassle” to update your card number with various billers. The fact that the old card number wasn’t automatically blocked is counterintuitive to combating fraud. At the very least, customers should be clearly informed of this option.

When the agent rattles off all those disclosures at the end of the call, most people don’t pay attention. I could have sworn I heard something about updating my card with automatic billers, but apparently it was the opposite.

Furthermore, the Amazon charges that came through after I reported my card number stolen were not even recurring charges (i.e. Prime membership). They were for purchases. So the idea that only subscriptions would continue to get charged is not accurate. Or secure, since thieves love linking stolen credit cards to their Netflix and Hulu accounts. At least in my experience.

Anyway, if you’ve had credit card fraud issues after the alleged GiftCardMall hack, you might want to circle back with American Express. Ask them to block any attempted charges to your old card number. This really should go without saying, but apparently, you have to say it.

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Leave a Reply