When I shared my manufactured spending report earlier this week, I got a lot of questions about the GoBank prepaid card. This card has been around for a while. I actually got it six years ago and did nothing with it, so it eventually got deactivated.

I think I was preoccupied with other cards like the Target Prepaid RED and didn’t get around to using GoBank. Reader Whitney put the GoBank card back on my radar and there was no good reason for me not to have one, so I picked up cards for myself and several family members.

Surprisingly, a lot of readers didn’t know about the GoBank card and asked for more details after reading my MS post. Hopefully, this guide will answer all your questions. If not, please leave them in the comment section and also feel free to add your own experience using the GoBank debit card.

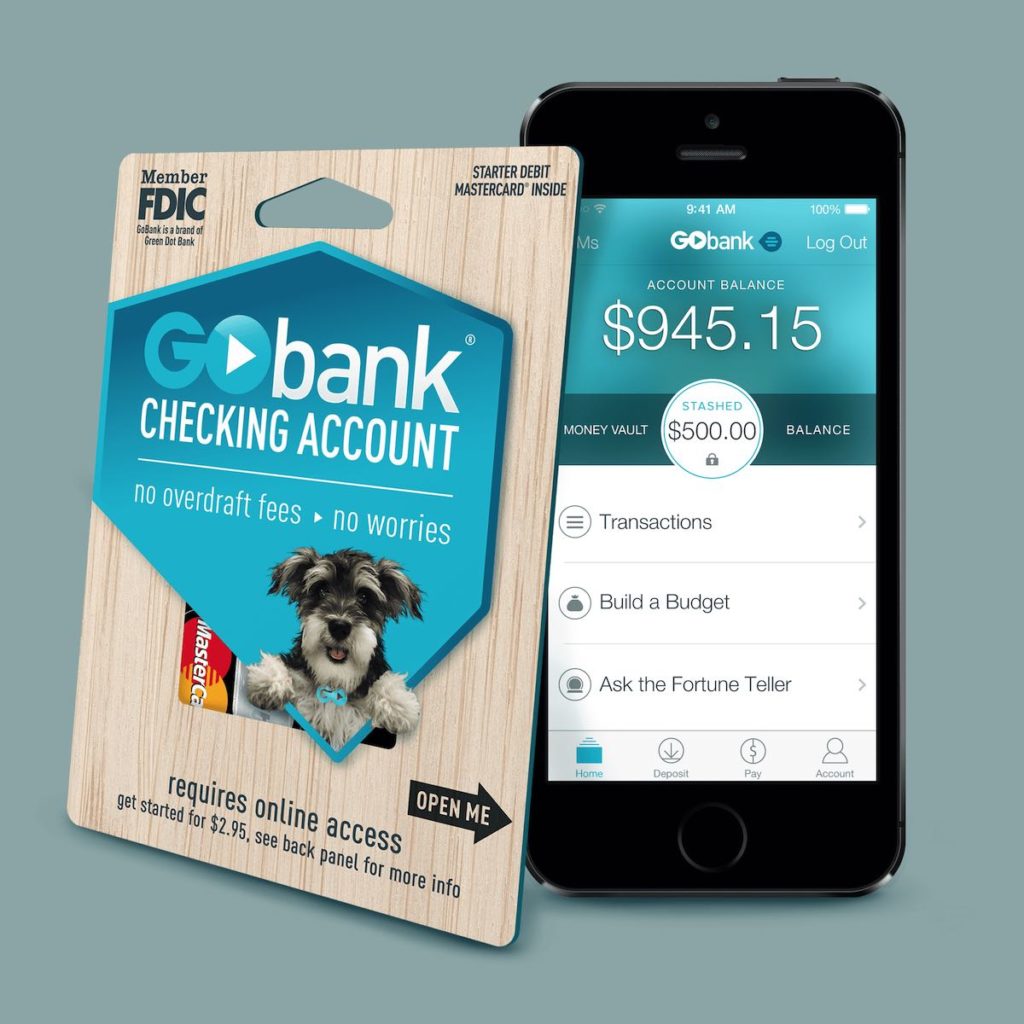

What is the GoBank Debit Card and Where Can I Buy One?

The GoBank debit card is a reloadable prepaid card you can buy at Walmart. It’s meant to be used as a banking alternative. You buy it, register for an account, then use it as you would any checking account. You can even request checks, pay bills and send money to others.

For the purpose of manufactured spending, this card is ideal for unloading Visa and Mastercard gift cards. If you’re loading up on Visa gift cards at Staples this weekend, the GoBank card is a great way to liquidate those cards without incurring money order fees.

GoBank Monthly Load Limit

Here’s where it gets confusing. I had heard that the monthly load limit on the GoBank card was $9,000. However, the GoBank FAQ page contradicts this. It specifically states that you can load up to $2,500 per day or $3,000 every 30 days.

I’ve loaded $4,000 to my own account over the last 30 days alone. So either the info on the page is incorrect or GoBank recently lowered the loading limit.

GoBank Daily Spending Limit

The daily spending limit on a GoBank Debit card is $3,000. That’s great if you decide to liquidate your balance through a money order purchase (if you’re in a hurry) and your local Walmart only accepts gift cards with your name on them.

GoBank Card and Checking Account Fees

The GoBank card carries a purchase fee of $2.95 and a monthly fee $8.95. The monthly fee is waived with a monthly direct deposit of $500. Some people have reported that ACH transfers qualify as direct deposits.

That’s much more convenient for those (like me) who don’t want to change their direct deposit preferences just for manufactured spending purposes.

How to Reload a GoBank Card FREE

Now the $0.88 cent question: How do you reload a GoBank card and does it cost anything? If you buy your GoBank Debit card at Walmart, you can reload it there with a PIN-enabled Visa gift card free of charge.

I can only swipe one card per transaction for GoBank reloads at my local Walmart (i.e. it has to be done in $500 increments). They do allow multiple transactions, but it’s just a little more of a hassle.

How to Cash Out Your GoBank Cards

GoBank funds can be cashed out via bill pay, money order purchases, checks ($5.95 per checkbook) and ATM withdrawals. The ATM withdrawal limit is $500 per day and fees may be assessed by ATM operators outside of GoBank’s network.

Is GoBank Safe for Manufactured Spending?

YMMV. I’ve been actively using the GoBank debit card for manufactured spending for over a month. I may get shut down next month or this could go on for years.

I’ve heard from people who got shut down immediately after maxing out the load limit. And I’ve gotten reports from those who have successfully maintained their accounts long-term despite occasional max-outs. Based on these report, I think it’s safe not to max out the monthly load limit.

It’s important to assess the risks and make your decision accordingly. If you do get shut down, can you go without the funds for 30 days or more? If not, then you should probably stick to buying money orders as a gift card liquidation method.

Is the GoBank Debit Card Worth Getting?

I think the GoBank Debit Card is worth getting as a supplemental tool for liquidating Visa gift cards. Walmart limits money order purchases to $8,000 per day, which used to be $10,000.

I know lots of people (myself included) who don’t particularly enjoy frequent trips to Walmart and want to maximize the number of gift cards they can liquidate per visit. The GoBank Debit card can help.

If the monthly load limit is, in fact, $3,000 every 30 days, it may not be worth it for everyone. I would definitely consider using direct deposit to off-set that $8.95 fee. Otherwise, you’re spending $107.40 to earn just 36,000 points per year.

Those fees (which don’t even include Visa gift card purchase fees) are more palatable when you’re earning 108,000 miles with a monthly $9,000 load limit. Otherwise buying money orders is cheaper.

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

last time I checked which was a while ago you could order the GoBank card from their website for free instead of paying the small fee to get it in store

But I don’t think you qualify for free Walmart reloads if you do it that way.

I definitely obtained my cards online for free and Ive always fone free Walmart loads. but this was several years ago so maybe im somehow grandfathered in? it may be worth double checking

Is a GoBank card any better than Serve or Bluebird for MS?

I think so. From what I’ve observed, Amex prepaid cards are much more prone to shutdowns. But that could change at any time.

can you tell me where I can purchase GOBANK online?

Google GoBank.

But if you want no-fee loads at WMT you must get the version sold at WMT. The online version will cost you to load. The WMT version is a Mastercard and the online version is a VISA, I believe.

Hello my dear?

also, i go over that $3k limit every month and have for years. Tahsir mentioned a few years ago at FTU Vegas that they don’t enforce the monthly load limits, however you can get shut down if you go overboard. apparently one of the keys is to make sure the balance is $0 when you are re-loading.

Interesting. I’ve been letting my balance pile up but I’ll definitely start taking your advice.

Thanks, Ariana (&Whitney!). Definitely looks like something to research further to see if it fits with my MS.

I had 4 accounts with GoBank for 4 years.It is make sense to use GoBank card only if you able to make direct deposits. Unfortunately, all banks are refusing to transfer money to prepaid accounts. I was using Schwab bank to transfer but my account was shut down and I suspect because of monthly transfer 500 dollars to my 4 accounts.GoBank would let me load up to $3500 GC money plus $500 direct deposit monthly. I closed 2 accounts and use GB only to load $200-300 GC from Staples.

By the way is any one having problem to buy GC from Staples.com with Chase Ink(old) credit cards?

Shouldn’t be a problem buying gc’s from Staples with the Ink card. I’ve been doing it for years.

What do you mean by “problem”? I use Chase Ink Cash for the 5X points at office supply stores and haven’t had any problems with it except for certain cashiers/managers limiting purchases to 1 per day. Others at same store let me buy 5. But that is supposedly a Staples corporate policy and has nothing to do with the card you are using.

Thanks for sharing! Does load at Walmart have to be done at Money Center or any cash register?

Yes.

Check your local grocery stores. Around here, they are cheaper than WMT and a lot less hassle.

All the other grocery stores around here require cash to purchase MO’s. Thankfully we’re small enough town not many other MS’ers around, so WM is still working ok here (for now)…

Any cash register.

in my area that died a couple years ago and now I have to go to the money center

I’m taking those SOBs to arbitration. https://www.doctorofcredit.com/gobank-prepaid-card-100-signup-bonus/#comment-704134

That sucks! Let me know how it goes.

I had the same issue when opening a GoBank Visa online. This does not happen when opening the GoBank MasterCard purchased at Walmart which is the one you want and I later switched to. GoBank customers service by twitter direct message is pretty good and they immediately agreed to credit me back that $8.95 since I had a qualifying $500 direct deposit that month. Deal with them rather than going to the mattresses with regulators and legal action.

My Staples manager says the daily limit on GC is $2000. He lets me go above it if I use a second cc and go to a different register with a different cashier. Of course it helps that i bring him and his staff homemade chocolate chip cookie and he knows what I am doing. I had no problem using my Chase Ink business cards this week purchasing the GC

@Air, Land and Sea – just curious, have you been buying this week? I have never had any issues until this current promotion. Had a manager get semi belligerent with me on Wednesday when I played dumb and asked why I could only have 1. He said he wasn’t going to jeopardize his job for people who are potentially money laundering – said that was the guidance from corporate.

Lol! I admire your hustle.

GB too risky. Got shut down and funds stuck for months. It was a nightmare to get the money back. Too much effort for little gain and more expensive. I prefer money orders to liquidate GC.

Are you still able to buy money orders with GC debit at Walmart, or do you go to a different place? I thought they stopped allowing that, so I haven’t tried lately.

Still able to where I live. Seems the restriction varies from region to region and even store to store. I always told them I wanted to buy a MO with X number of debit card and they only ask if it is pin enabled, which of course they are. I also always change the pins so as to avoid having to look at the card.

You might check grocery stores that sell MO’s. Around here they are cheaper than WMT, anyway and a lot less hassle / scrutiny.

Do you mind sharing with us the volume that you were doing when you got shut down? Also it’s actually less expensive than money orders if you do direct deposit to avoid the monthly fee

The load varied by month between 1k to 4k with some legit spend as well. Lasted 5 months or so. My time is more valuable than the hassle or the little gain it brought

hmmm i do much more than that and have for years! were you only loading when the account balance was $0?

What is your daily/monthly load? And how have u been unloading?

i load either $1,500 or $2k at a time. $5-6k per month. so $10-12k per month between my 2 accounts. i drain the account via bill pay before reloading and i do direct deposit to avoid the monthly fee.

also i don’t do any legitimate spending

Noticed you said you have 2 go bank accounts. Can you have multiple accounts in the same name?

Are there any VGGs that can’t be loaded to GB (ie Vanilla)? And can GCs be loaded online or do you have to go in to s Walmart?

After reading through doctor of credit post on gocard, I think I will give it a pass. There are many mixed reviews and I understand everyone has different tolerance levels but may be for me only, I will sit on the fence.

You should definitely do what you’re most comfortable with.

Great writeup! A couple of questions:

* Can you use any pin-enabled GC, or just VGC?

* I’m not finding text anywhere on GoBank’s website about free deposits if the card was purchased and loaded at WM. Has this changed?

at Walmart have to be done at Money Center or any cash register?

Money Center

Disregard. I thought you were asking about MO’s.

When you say you can unload GoBank via bill pay are you saying you can pay a credit card balance? If so, are there any bank credit cards that are not accepting GoBank bill pay? -thanks

Is it possible to load them anywhere other than Walmart? There are none within 12 miles.

Yes, you can also reload it at CVS, 711, Riteaid, and Walgreens. Retailers other than Walmart might charge a fee.

Reading through the faq’s for GoBank, it says you can deposit MO’s through their mobile app. Is there some reason you don’t do this instead of going to WMT? It didn’t specify what, if any, fees are associated with the mobile deposit.

Ugh. Never mind. Don’t know what I was thinking. Had a brain fart.

One card per transaction is actually not accurate. If you do it at MC or CS you can ask them to split tender, maximum three VGC swipes totaling $500, for example $200 + $200 + $100.

Of course this is YMMV depending on your local WM. However if you’re able to split tender for MO, you’ll be able to split for GB load as well.

That hasn’t worked for me. Every time I try a split transaction on GoBank loads, the register sputters out a tiny receipt and an error message. Kind of like what happens when you exceed maximum swipes for money orders.

Curious what other grocery stores people are using for MO’s using debit gc. I’ve used Publix successfully just only $500 increments and fee was around $1.

I use a regional grocery chain that has a couple of different store names. They carry Western Union MO’s up to $1,000 for 79 cents. Where I live it’s either WMT or the regional chain. No national chains around here (middle America, a.k.a. flyover country).

I just have to ask, I got a Bluebird card for intention to pay mortgage. Anybody doing it?

talk about $#!ting where you eat, don’t do it

OK, thank you for your advise

Please let me know if it works in this case…

1. Open GoBank Debit Card account with checks

2. Buy SimonMall Visa Gift Cards

3. Load Simonmall visa gift card to GoBank Account

4. Write checks from GoBank to pay mortgage or car loans.

Is there a difference between GB cards? I ordered my GB card online after creating an account. They sent me a Visa debit card. I went to WM to load and was charged $3.74 for the load. I thought the loads at WM were free?

Do you have to get the card ‘AT’ WalMart for it to be the free load version? Is the version from WalMart a MC and not Visa?

Yes, you need to get the MC version at Walmart for the free loads at WM. You can close the Visa card and set up the new MC with a different email address.

Thank you!! I’ll do that for sure.

For some reason the Visa GoBank is much more difficult to use. It refuses or declines most international transactions. I’ve never had a problem with the MasterCard version of the GoBank. It’s always the visa that closes for certain reasons. I’ve had great success thus far with the Am Ex Serve other than meeting the max load early in the month. Is there any advice someone can give on loading the Serve card past the max load. I mean it generally will allow over the limited somewhat. Also can you have more than one serve card? I love the cash back. It accumulates quickly and helps out.

Ariana, we need help. This week we purchased six $200 MasterCard gift cards from Staples with no fee. That worked great. Two weeks ago we purchased the GoBank MasterCard card from Walmart and even transferred $500 over from our Chase checking account which showed up as a direct deposit. That worked great too. However, today we did not have a good Walmart experience. First we took the GoBank card and one $200 MasterCard gift card to the cash register… asked them to load $200 onto the GoBank card I swiped the Staples card and I said yes to the button that asked if I wanted to load $200 dollars and the card was denied. Then we took the same cards to customer service asked them to load $200 onto the GoBank card, I swiped the Staples Mastercard and was denied once again. Then, we asked to create a money order with the MasterCard gift cards swipe the cards and again were denied. Maybe this Walmart didn’t know how to deal with these cards, so we went to another Walmart 20 miles away. We repeated all three scenarios above with cashier and the customer service agent. All three scenarios again were denied. At this point, we don’t think we will be able to liquidate these $200 MasterCard gift cards from staples onto the GoBank platform. Please advise.

Mastercards don’t work like Visas at WM. Can’t do more than $50.

I am having trouble setting up transfer from bank to GoBank. Any help would be appreciated. I have been looking online for info but stuck on how to proceed. Thank you.

Same here. I was hoping I could set up a monthly ACH transfer to avoid the $8.95 monthly fee, but my bank says the routing number is invalid. Are you having the same issue?

With my credit union I am clueless how to figure out how to do it. DUH. I am going to try a different credit union that I have an account with and it looks straight forward. Sorry I don’t have anything to report yet. I want to avoid the monthly fee as well.

has anyone has success connecting a bank for ACH transfer? I get: routing number is invalid.

I have accounts at 4 banks, and for some reason they all have ACH transfers to GoBank blocked.

I just send myself money to my GoBank account from one of the other banks through Google Pay. It works for getting the monthly fee waived.

Picked up a Go Bank card and after setting up online account it stated it is a “LIMITED USE ACCOUNT” . Has anyone else seen this ? Not sure what to do, since it states I can’t load, pay, withdraw, etc. Is this just until I receive the new card in the mail ? Thanks for the help.

That’s just until you get your permanent ATM/Debit card.

Thanks Ed !! I didn’t notice it when my husband enrolled his previously. Happy New Year !!

Just as a data point : I contacted GoBank since the new card still hadn’t come in the mail. They said they were not able to verify information and that once I use the $20 on the card the account is closed. Only thing that was different was I created a new email for it.

Weird. Did they say what they couldn’t verify?

I use my GoBank card to liquidate Staples VGCs all the time (every day this week, actually….} and have never had an issue other than figuring out how to get the $8.95 monthly fee waived since I don’t have any income that can be direct deposited. But, even that issue has been resolved and I haven’t paid a monthly fee in 4 months now.

Very weird 🙁 What type of volume are you able to do daily/weekly on your GoBank ? I will try to use my husbands card. Thanks..

So I have seen some posts saying get the Visa GB and some say the MC GB. I’m kind of confused as to what the differences are and which to get at Walmart? I’m not understanding why one is different than the other. Was looking to get one in store.

TIA!

You want the one that is sold at WMT. It is the only one you can load at WMT for free.

Beechy – There is a daily limit on loads, but I haven’t figured out exactly what it is! I have no problem loading $400 per day (2 – $200 VGCs from Staples). I usually keep it to less than $4,000 balance, then drain the account (pay the credit card bill off) before loading more. It’s worked so far!

Glad it is working for you. I will report back if I am successful with hubby’s card. Thanks 🙂

I loaded 2 vgc’s at Walmart back to back yesterday but only 1 of the transactions showed up and my balance is also short $500 from one of the loads. I’m used to seeing the transactions drop off before but usually it’s in my balance. Any idea?

Ed, how do you pay the credit card bill with GB balance? Using bill pay? or generate a check payment? TIA.

You just list GoBank as one of your “Pay From” accounts as you would any other bank. No bill pay or generate a check payment. Choose GoBank as the account to pay from and it’s done.

Thanks for your reply….. Normally credit card payment can only be set up by bank routing and account numbers, if GB has a bank routing number, I didn’t know that. I have a new GB that came in the mail, but just haven’t register or activate it.

Yes, GoBank has routing and account number just like any bank checking account.

Did you buy the one at WMT? It’s the only version that you get free loads with….

Test comment