Points and Miles Beginner’s Guide

#9. Qualifying and Applying For Business Credit Cards

NOTE: Check the Credit Card Database for a comprehensive list of point and mile-earning Business credit cards, along with their sign-up bonuses and features.

Business credit cards are a great way to earn bonus points after you’ve exhausted the top personal card offers. While the bonus point offers for business cards aren’t as lucrative, they’re still a nice way to top off a mileage account. The best part is that your personal credit history does not factor as heavily into the decision process as it does with a personal card (unless you provide your Social Security Number in lieu of a Tax ID). Most business cards are charge cards (meaning they have no preset spending limit) and need to be paid off at the end of each month.

Many point aficionados will attest to the fact that you don’t need a traditional business to qualify for a business credit card. If you sell items on ebay, run a lemonade stand, or anything else that generates income outside of a normal work paycheck, that qualifies as a business. Daraius Dubash gives a step-by-step guide on how to fill out a business card application.

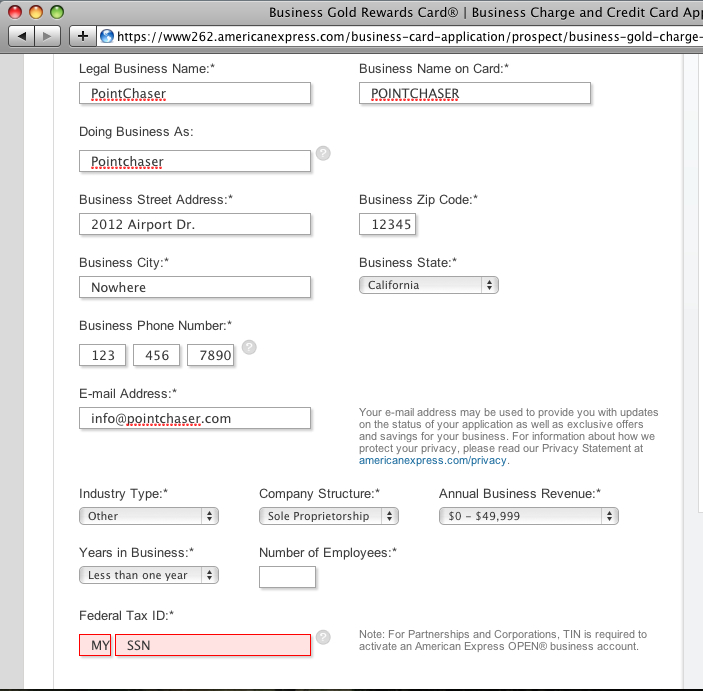

Here is a brief summary of how to fill out a business card application:

Legal Business Name: If you don’t have a DBA (Doing Business As), enter your name. Otherwise, provide the name of your business.

Federal Tax ID: If you do not have a Tax ID, provide your Social Security Number. If you choose to provide your Social Security Number, your personal credit will be pulled.

Years in business: If you’re just starting out, choose “less than 1 year.” If you don’t have this option, just enter “1” as the number of years in business.

Business Address: If you don’t have a business address, provide your home address.

Number of Employees: If you’re the only employee, enter “1.” Otherwise provide the number of people who work for your business.

Industry: Options will vary by credit card company. Select what is most relevant to you. For example, for the American Express Gold card, you can choose “retail trade” if you sell items on ebay.

Company Structure: If you don’t have a traditional business, go with “sole proprietor.”

Questions or comments about business cards? Will you be applying for a business credit card after this? Leave your questions or comments below.

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Leave a Reply