Latest articles

-

Freebies galore with Bilt’s June 2023 Rent Day promotion

•

Bilt is turning two in June, which means Rent Day is about to get more extravagant than usual.…

-

Is Capital One Price Freeze a scam? Here’s how the service cost me $300

•

I’ve had a Capital One Venture X card for a year and recently decided to use Price Freeze…

-

Spirit and Frontier are merging into one terrible airline and no one is admitting it

•

By now, you’ve probably heard more than you can stomach about the Spirit/Frontier merger. You’ve read through the…

-

I’m back – join me for a virtual meet-up/fundraiser!

•

You know those annoying posts from the early days of blogging where the author would apologize for not…

-

A new chapter

•

It’s been an intense few weeks, both in terms of work and life. As some of you know,…

-

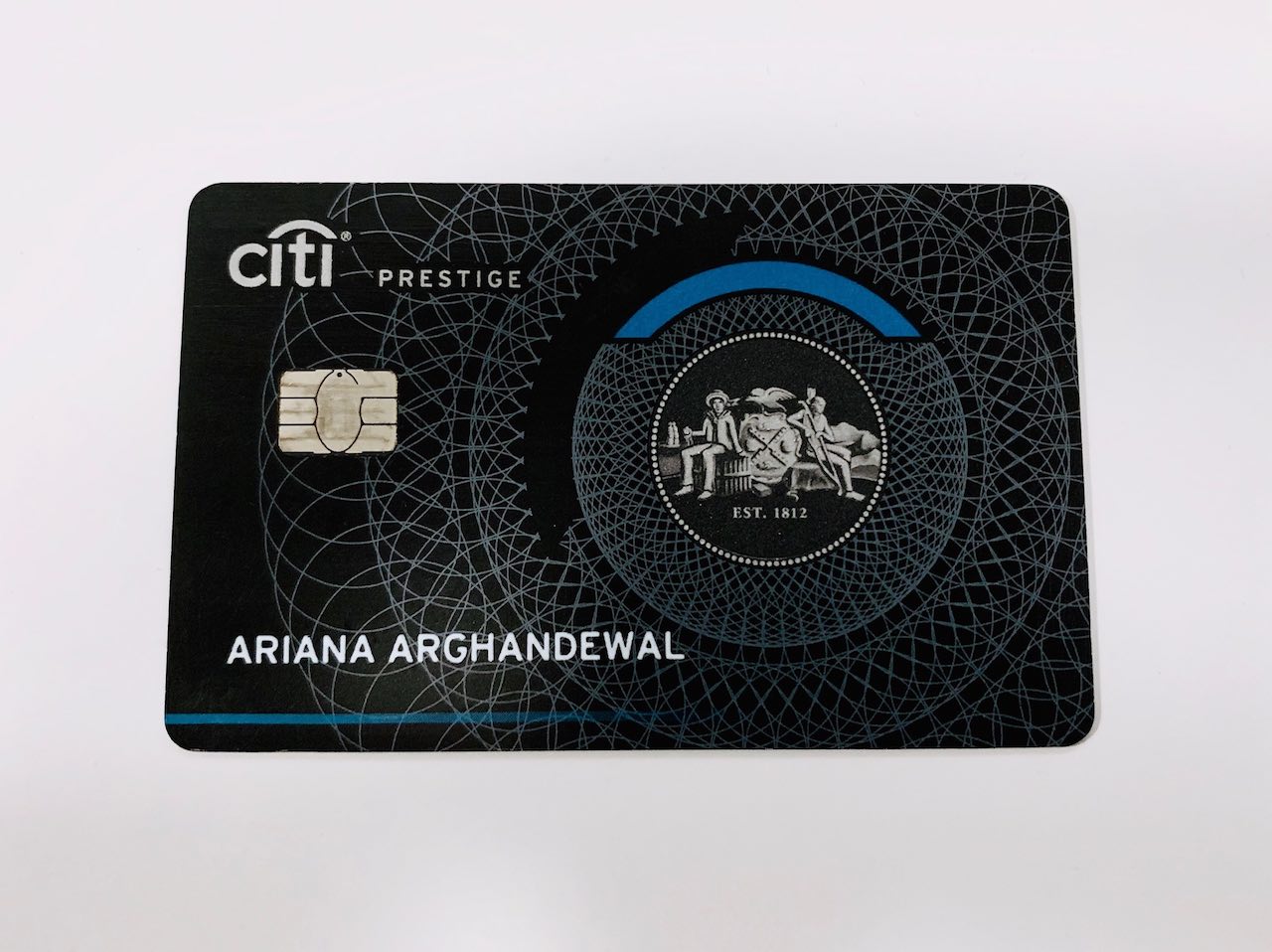

Citi Prestige Card: Keep or cancel?

•

The annual fee on my Citi Prestige Card is due pretty soon and like some of you, I’m…

-

My week in manufactured spending: The dreaded shutdown

•

After a 10-day trip to Turkey, I was happy to be home and getting back into my manufactured…

-

What no one tells you about noise canceling headphones

•

Did you know that noise cancelling headphones can cause severe ear pain, jaw pain, headaches, and disorientation? I’ve…