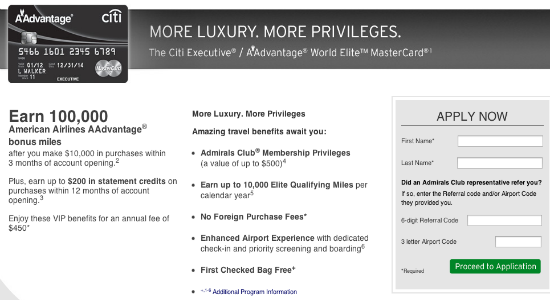

Back in January I wrote about the amazing 100,000 mile Cit AAdvantage Executive card (of which you can get two). I jumped on that offer immediately and also picked one up for my family members. The cards come with some pretty great travel benefits, including Admirals Club membership, priority boarding, priority security (or as my brother likes to call it, “the privilege of being randomly selected ahead of others”), free checked bags, etc.

The Admirals Club membership is pretty valuable and the timing is perfect, since my brother will be heading to Managua next week, with a long layover in Miami. I began looking into how to activate the Admirals Club membership and it’s actually pretty simple.

All you have to do to gain access to an Admirals Club lounge is walk into the lounge and present the following:

- Your AAdvantage number

- Government-issued ID

- Your Citi AAdvantage Executive card

The Citi AAdvantage Executive card has no foreign transaction fees. So it’s easy to justify having the card on hand along with other required documents when you’re traveling.

It’s also worth pointing out that you can guest in the immediate family or up to two travel companions. Those who already have an Admirals Club membership and end up picking up this card will receive a pro-rated refund on their membership fee. Combined with the $200 statement credit, this can further minimize the $450 annual fee.

Does this work for access to international lounges?

Yes, this works at all lounges.

hi – if i apply for a 2nd aa citi 100000 card, what do i say when they ask why i need another one? (assuming i have to call the reconsideration line.)

You can tell them you’re looking to separate your expenses (i.e. business and personal). I applied for myself and two other people and the reps did not even mention our existing cards.

awesome! thx

hey – so I’ve got 2 of these and completed my min spend on both, also recieved the annual fee charge AND the statement credit. I want to get rid of one of these(at least) and was wondering how to go about requesting the AF if it’s possible. Would you have info on this? -thanks!

Citi has gotten pretty stingy about waiving annual fees, but if you’re done with both cards and are ok with canceling, just give them a call. They may waive the remainder of the fees to keep your account open.

thanks! I really don’t want to keep 2 of these cards. I’ll hang on to 1 just for the lounge access. I’ve marked my calender to call them on the 35th day to see about what to do with it. The miles are already spent!